About the Training

You might be wondering, what exactly is Financial Services and what jobs can I get after completing this training? Summit Financial Services graduates are currently in these types of roles in the Twin Cities:

• Financial Services Professional

• Customer Service Representative

• Community Banker

• Insurance Sales Representative

Whether working in a bank, credit union, insurance company, mortgage lender, or investment firm, you can play a key role in building trust with clients and supporting the financial well-being of your community.

Enroll in Summit’s accelerated 20-week Financial Services training and kick-start your career! You will gain a new set of technical and professional skills to prepare you for entry-level jobs—all at no cost to you.

Top Financial Services Graduate Jobs

Mortgage Closing Coordinator

Member Services Representative

Servicing Support Specialist

Client Support Associate

Bank Teller

Insurance Sales Agent

Gain the skills you need to land a career quickly.

Financial aid supports your full tuition.

Most students earn a higher wage after Summit.

What Financial Services Students Say

Aster, ‘25

Cody, ‘26

Mataly, ‘25

PassiaNet, ‘25

Courses & What You’ll Learn

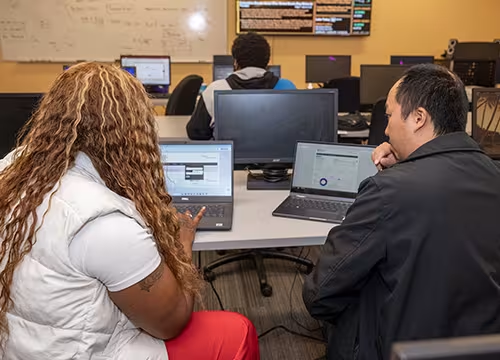

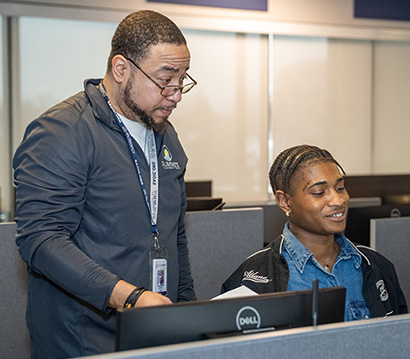

Our dedicated instructors and staff will support your 20-week journey.

Weeks 1-10

Basics of Financial Services

During the first 10 weeks of the training, students will learn the fundamentals of the financial services industry. The instructors teach the necessary concepts and skills needed to prepare and place students into entry-level positions.

Students will gain a deeper understanding of financial processes and practices, with a strong emphasis on mortgage loan servicing, insurance, and customer experience.

Classes meet in-person, Monday–Friday from 8:30 a.m.–2:50 p.m.

Goals

- Demonstrate personal financial literacy

- Understand the fundamentals of finance

- Gain proficiency in the Microsoft Office suite

- Develop customer service and professional communications skills

- Demonstrate skill with foundational mathematics and data presentation

Phase I Courses

- Introduction to Finance

- Securities Essentials 1

- Math Essentials

- Microsoft Office

- Professional Communications

Weeks 11-20

Practical Experience

During Phase II, students are still learning the basics of financial services, but are also developing deeper skills and hands-on training in mortgage loans, insurance, and customer success models. Students will also begin preparing for the Securities Industry Essentials (SIE) exam.

If a student passes the SIE exam, they will gain this industry-recognized credential covering securities industry information and concepts fundamental to working in the industry, such as types of products and their risks; the structure of the securities industry markets, regulatory agencies and their functions; and prohibited practices.

Classes meet in-person, Monday–Friday from 8:30 a.m.–2:50 p.m.

Goals

- Explain the essential functions and practices of the mortgage loan processing sector

- Understand the functions and practices of the insurance sector

- Demonstrate an understanding of customer success management

- Explain the securities industry and securities products and terminology

- Create and produce a resume, and participate in mock interviews

- Attend a hiring fair on campus and connect with employers

Phase II Courses

- Securities Essentials 2

- Lending Principles

- Insurance Essentials

- Customer Service Experience

- Career Development

Steps to Enroll

Complete Application

Complete the online application. We’re here to help if you have questions!

Pass Placement Test

A Summit staff member will contact you to schedule an on-site placement test. Testing generally takes 2-3 hours. Passing requirements vary by program.

Complete the FAFSA

You must complete the online Free Application for Federal Student Aid (FAFSA). Our school code is 015950.

Financial Aid Meeting

After completing the FAFSA, you will receive an email from your financial aid counselor to set up a meeting to discuss next steps. If you are 25 and younger, you will need financial information from your parent or guardian.

New Student Orientation

Attend a half-day orientation on campus one week before your start date. More information about this event will be provided to you once you have completed all prior steps and are enrolled.

Begin Your Journey

Congratulations! By this step, you are a Summit student. We look forward to having you on campus and supporting your individual journey.

Financial Services FAQs

Below you will find questions and answers specific to the Financial Services training, or you may also visit our general Summit FAQs.

Students are required to:

- Be at least 18 years of age.

- Have earned a high school diploma or GED, which must be presented if requested.

- Bring a valid State ID, driver’s license, or other government issued ID to all testing and meetings with admissions staff.

- Pass the placement test. Passing requirements vary by program.

- Complete the FASFA form and meet with a Financial Aid counselor.

Summit Financial Services graduates are prepared to fill a variety of entry-level positions at financial institutions. Many of our past graduates have gone on to fill roles such as: Financial Services Representative, Customer Service Representative, Community Banker, and Insurance Sales Representative.

We partner with many local employers, and especially have strong partnerships in the financial services sector including with Ameriprise Financial, Bremer Bank, Wells Fargo, US Bank, and more. See a list of employers we partner with here.

Yes! We have an entire team dedicated to supporting your career journey beyond the walls of Summit. We have staff who will work with you throughout the 20 weeks on workforce readiness skills and staff who will help connect you directly to employers towards the end of your coursework. We also host on-campus mock interviews and hiring fair events.

Many companies in the Financial Services, IT, or Healthcare fields require background checks prior to hiring. This may include both criminal and financial. Having a felony record WILL affect your ability to find employment in those fields.

We encourage students with a felony background to look at our construction trainings in Carpentry and Electrician.

Questions? Contact Our Admissions Staff